House Republicans are split over whether they would consider raising taxes on the wealthiest Americans as GOP lawmakers negotiate ways to pay for President Donald Trump's multitrillion-dollar agenda.

"Personally, I think that that should be on the table if we're not going to make spending cuts, but I hope we make spending cuts," House Freedom Caucus Chairman Andy Harris, R-Md., told Fox News Digital Monday.

On the other side of the debate, Republicans like Rep. Randy Fine, R-Fla., has said, "I'm a hard no on any [tax hike]. The problem is not that the government does not have enough money. The problem is the government spends too much money."

Congressional Republicans have begun work in earnest to craft a massive piece of legislation aimed at advancing Trump's agenda on a broad array of issues — border security, immigration, national defense, domestic energy production, the debt limit and taxes.

The tax portion alone could cost as much as $4.5 trillion over the next 10 years, according to House Republicans' framework for the bill.

Conservative fiscal hawks have, in return, demanded at least $1.5 trillion in spending cut offsets. And with the deadline to act on the debt limit expected to hit sometime this summer, Republicans are on the clock to reach an agreement between the House and Senate and send it to Trump's desk.

A possible increase in taxes on wealthy Americans is just one avenue Republicans are looking at to help pay for Trump's newer policies that include eliminating taxes on tips, overtime wages and retirees' Social Security.

Rep. Nicole Malliotakis, R-N.Y., a member of the House's tax writing panel, the Ways and Means Committee, suggested a small tax increase could be considered.

"There's potentially some talk about a tax hike on wealthier Americans. I think our goal in this committee, and the president's goal, has been to provide tax relief for the working and middle class," she said.

Rep. Marlin Stutzman, R-Ind., signaled to Fox News Digital he would be open to it too but acknowledged the risks.

"I'm open-minded to what the president or the treasury secretary may have in mind. And I would want to see some numbers behind it and how it would have an effect on the economy," Stutzman said. "What I've heard from people in the upper tax brackets is, you know, they're willing to pay more as long as they know that it's paying the debt down. They don't want to see it go towards more spending."

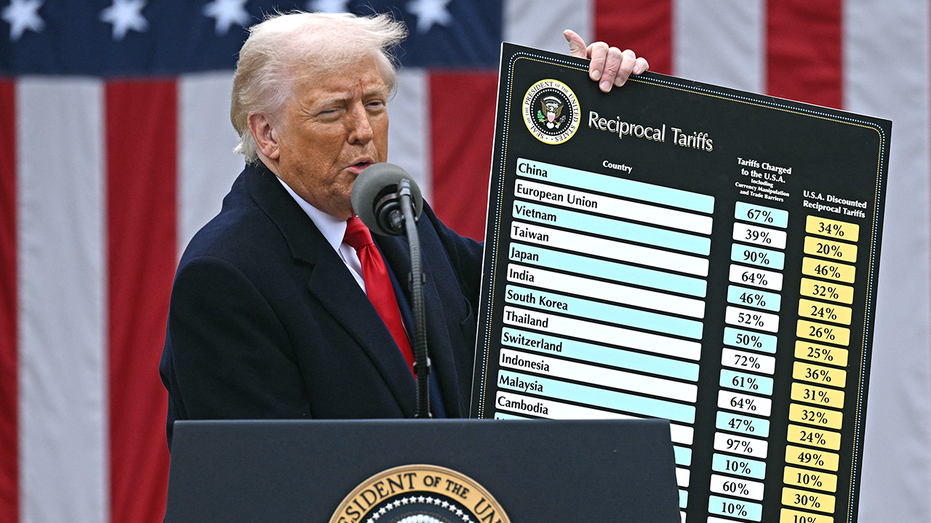

He added, however, that with financial markets still wrestling with reactions to Trump's tariffs, "raising taxes is probably not a good conversation to have."

In addition to Trump's new tax policies, Republicans are seeking to extend his 2017 Tax Cuts and Jobs Act (TCJA). Many of its provisions expire at the end of this year.

Rep. Nathaniel Moran, R-Texas, another Ways and Means Committee member, pointed out that failing to pass a bill altogether and allowing TCJA to expire would lead to a tax hike for millions.

"I do not support raising taxes across the board at all. I want to keep those taxes low," Moran said. "But if we don't do anything, inaction will bring the largest tax hike in American history. We cannot let that happen."

SCOOP: PENCE URGES REPUBLICANS TO HOLD THE LINE ON TAX HIKES FOR THE RICH AS TRUMP WEIGHS OPTIONS

Rep. Chip Roy, R-Texas, did not specifically weigh in on tax hikes when asked but said Republicans would fall short of their tax goals if proper spending cuts were not found.

"All I care is that we actually do math with reasonable models based on reasonable assumptions. And so, look, to the extent that my colleagues are unwilling to do the shrinking and reduction of government that is necessary, then we're going to have to deal with the tax side of things," he said.

"And that means not being able to get full 10-year [extensions], not being able to get every single tax extension that you want, not getting some of the new tax cuts that we want. So, all those things will end up being on the table if we don't do our job."

Rep. Mary Miller, R-Ill., said, "I don't support tax hikes. I support spending cuts."

House Ways and Means Committee Chairman Jason Smith, R-Mo., would not share any details of the forthcoming plan when asked about a possible tax hike.

"There's a lot of things that I've been reading in the press that have not been accurate, but I'm not going to say whether it's accurate or not, and they'll see the bill whenever we deliver it right before markup," Smith told Fox News Digital.

CLICK HERE TO GET THE FOX NEWS APP

"But what I will say is, is that we will have a tax bill that is pro-growth, pro-jobs, pro-family, pro-small business and pro-workers. And Republicans believe in making sure that Americans keep more of their hard-earned dollars, and you'll see a tax package that does that."

He said Americans would likely get to see that plan in a matter of "days, not months."

When reached for comment on the possibility of tax hikes in Trump's agenda bill, a senior White House official told Fox News Digital, "The president is reviewing a wide range of tax cut proposals for inclusion in the reconciliation bill. He is most focused on tax policy that will help create more good-paying jobs in America and delivering the major tax cuts he campaigned on for working and middle-class Americans."

.png)

3 hours ago

8

3 hours ago

8

English (US)

English (US)