The Department of Government Efficiency and Elon Musk have kicked up a storm of commentary and speculation. Pair that uproar with the Trump administration’s plan to slash IRS staffing, and you get some of the most hysterical responses yet to the Trump/DOGE reforms.

Only in government does talk of doing more with less — of improving efficiency and productivity — trigger panic and outrage. In Washington, D.C., progress becomes a threat, not a goal.

Instead of whining about the DOGE’s proposed staffing cuts, politicians and pundits should demand the IRS do its actual job more efficiently. That requires systemic reform, not partisan noise.

According to multiple reports, the Trump administration plans to cut around 18,000 IRS jobs by mid-May — a 20% reduction in force expected to save taxpayers $1.4 billion in payroll and benefits next year. Of those cuts, 6,800 already came from terminated probationary employees. Another 4,700 took early retirement.

Critics didn’t wait for results. They declared it “historic,” “unprecedented,” and a sign of doom. The sun, they warned, might never rise again.

But we’ve seen this before. The world didn’t end. In fact, almost nothing changed at all.

In 2011, the IRS reported 94,709 full-time equivalent employees. By 2017 — after five years under the Obama administration — that number had dropped by more than 23%, to 72,803. The sun still rose. The sky didn’t fall.

Despite the staffing cuts, the IRS’ key performance metric — the voluntary compliance rate — barely budged. For decades, the VCR has served as the agency’s primary benchmark. It measures the percentage of taxes paid voluntarily and on time, compared to the total amount owed.

Commonly known as the “tax gap,” the VCR draws bipartisan attention. Lawmakers on both sides of the aisle treat closing the gap as a fiscal priority — more compliance means more cash to spend.

Yet, through two decades of staffing shifts and budget battles, the VCR has remained remarkably stable — hovering around 84%, give or take a fraction.

Yes, adding more IRS agents might improve compliance on the margins. But staffing alone doesn’t guarantee better outcomes. What matters is how the agency sets its priorities and manages its workforce to deliver results that actually benefit taxpayers.

In 2012, the Government Accountability Office reviewed how the IRS could improve enforcement and shrink the tax gap. The GAO’s conclusion: The problem wasn’t a lack of staff. The IRS could significantly boost revenue simply by better targeting its enforcement resources.

That’s exactly what the DOGE is about: smarter management, better systems, and measurable results. The private sector achieves this through the pressure of competition. In government, such efficiency is about as rare as a unicorn.

Like every other agency the DOGE has examined, the IRS drifted from its core mission: collecting revenue and enforcing tax law. Instead of focusing on enforcement, the agency expanded into mission creep.

Trump plans to shut down the IRS Office of Civil Rights and Compliance — and for good reason. These bloated bureaucracies have become one of the most redundant features of Washington. The only thing more common than a civil rights office is a federally funded jobs training program.

And like rabbits, they just keep multiplying.

Then there is the Biden administration’s favorite: diversity, equity, and inclusion. Trump has rightly proposed shutting down DEI offices across the federal government. Hiring $200,000-a-year “senior diversity and inclusion specialists” at the IRS won’t close the tax gap — not by a long shot.

In the high-tech 21st century, the IRS still struggles with basic technology.

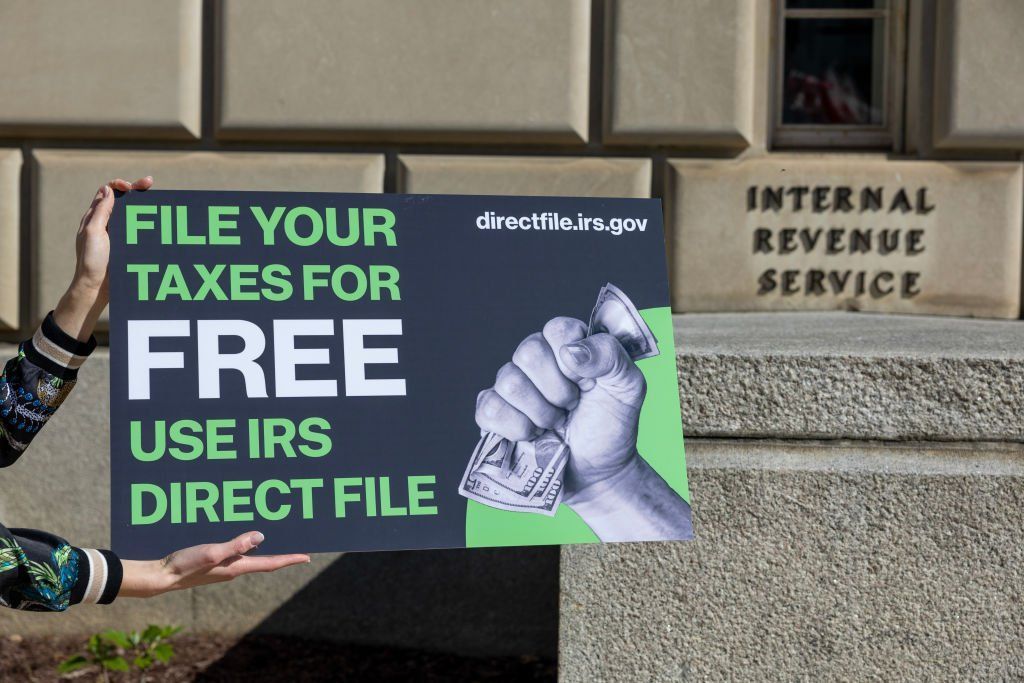

Just weeks ago, the Treasury Department’s inspector general released a report on the IRS’ Direct File pilot program. The IRS launched the program to help taxpayers file returns from February to April 2024 — and it flopped.

Despite existing free filing options from both the private sector and the IRS, Direct File was pushed forward as one of Sen. Elizabeth Warren’s (D-Mass.) latest policy “experiments.” According to the inspector general, the project cost taxpayers at least $33.4 million — far more than initially disclosed.

The results were underwhelming. Only 140,803 of the 423,450 people who created Direct File accounts — just 33% — successfully submitted returns. Many of those who did lost out. The report noted that Direct File didn’t even allow eligible filers to claim their education tax credits. That’s not a minor oversight — it’s a costly failure and needs to go. Trump last week indicated he will end the program.

In just four years, Joe Biden added more than 20,000 full-time employees to the IRS. Did anyone notice the agency working better? Didn’t think so.

Instead of whining about the DOGE’s proposed staffing cuts, politicians and pundits should demand the IRS do its actual job — collect revenue and enforce the law — more efficiently. That requires systemic reform, not partisan noise.

The Trump administration gets it. It’s time the rest of Washington caught up.

.png)

6 hours ago

4

6 hours ago

4

English (US)

English (US)