In the wee hours of the morning of Oct. 10, in Oslo, Norway, the Nobel Peace Prize Committee started to notice something strange. On the online prediction market Polymarket, the Venezuelan opposition leader María Corina Machado’s chances at winning the prize started to dramatically spike.

The likelihood that Machado would win — as reflected by the market — had been sitting at around 4 percent for weeks, but on Oct. 10, it spiked to over 70 percent in less than two hours. The drastic change was driven in part by a single bettor, who had created a new account on the platform with the username “6741.” When Machado was in fact named the victor hours later, the bettor walked away with tens of thousands of dollars in profit — and left behind a host of questions for the Nobel committee and the quickly growing prediction market industry.

The Norwegian Nobel Committee quickly announced that it would begin a probe into the betting activity, looking for whether confidential information was released ahead of the incident. Ultimately, it might not have been a leak at all: One poster on X speculated how a savvy bettor could have figured out the prize recipient using publicly accessible metadata from the Nobel Prize website.

Still, the fallout of the incident was closely watched by another group: those hoping that the predictive power of betting platforms will soon transform politics and political media.

In the past few years, both the number of such platforms and their number of users have skyrocketed. Two are taking off particularly rapidly: Polymarket and Kalshi. In the 2024 presidential election, Polymarket users bet $3.6 billion on the presidential race alone. Kalshi’s market was around $250 million.

The rise of political betting is not just lucrative for the bettors and the platforms. Its advocates also hope that one day, it can replace the political prediction industry generally and remake the larger political media ecosystem. “[Traders are] incentivized with cold, hard cash to separate the emotion, to make a bet with their head rather than the heart,” said John A. Phillips, the CEO of the betting platform PredictIt. That means, the boosters argue, that they are more accurate than traditional polls and analyses of those polls.

But the Nobel incident highlighted just one of many challenges in using these markets as predictors of political events. Those opposed to the spread of betting platforms insist that the episode shows just how the markets incentivize people to disclose sensitive information. This is one of many risks involved in the proliferation of betting platforms, such as people creating disruptive events themselves or using money to try to manipulate election outcomes.

“We’ve seen examples of where a wealthy individual or entity will throw down bets on one candidate [in an election] to make it look like they have real support,” said Craig Holman, a government affairs lobbyist at the nonprofit consumer advocacy organization Public Citizen. “Betting not only trivializes elections, it can also make them subject to manipulation by very wealthy special interests.”

Those who support the spread of betting markets argue that the Nobel leak was just one example of how the platforms can give observers more information more quickly about the state of the world — the reason that many seem to prefer the markets to more traditional forms of political forecasting in the first place.

Pratik Chougule, the host of the Star Spangled Gamblers podcast and a regular political bettor himself, suggested that widespread distrust of institutions had paved the way for people to embrace betting markets. “That backdrop has been very important for drawing widespread interest in prediction markets,” he said. “I think it certainly lends support to the idea that these markets are important for the public and our public understanding.”

That’s why so many betting advocates see the Nobel incident not as a warning light but as an example of how political betting can find an edge over its competitors — and why these platforms are only going to keep growing.

Prediction markets are framed around simple yes or no questions. For example, a market on the site Polymarket asks: Who will win the 2025 election for Mayor of New York? You can buy shares of “yes” or “no” from other bettors on Zohran Mamdani, Andrew Cuomo, Curtis Sliwa or other candidates; the markets operate in a similar way to trading stocks. A share can cost between 1 cent and 99 cents; when the outcome that you bet on comes true, you’re paid $1 per share, and when it doesn’t, you get nothing. And generally, the price of “yes” shares is equivalent to the implied probability that an event will occur — Mamdani shares are trading at 92 cents and Cuomo at 7 cents. The betting public on Polymarket has thus concluded that Mamdani has a 92 percent chance of winning the election, with Cuomo at 7 percent (because of the betting mechanism this doesn’t always add exactly to 100; Sliwa shares are trading at below 1 cent).

Investors, for one, see massive potential in the platforms. On October 7, the Intercontinental Exchange — the owner of the New York Stock Exchange — announced a $2 billion investment in Polymarket at a post-money $9 billion valuation. Just three days later, Kalshi announced it had raised over $300 million from venture capital firm Sequoia Capital at a $5 billion valuation. That’s a 2.5-time increase in value from its last fundraising round just three months earlier.

But another group is paying attention to these platforms’ rise: those who have a special interest in political predictions, from campaigns to journalists to any number of groups and individuals who might be affected by the outcome of an election. Rather than relying solely on polling, punditry or counting yard signs, in advance of big election nights, the markets put together all available information and spit out a number that looks like the collective wisdom of a lot of people with money on the line. That can often lead to a number that is a more comprehensive reflection of a certain candidate’s chances of winning than any single poll or piece of political analysis.

“I think we are really at the tip of the iceberg,” said Tom Schmidt, a general partner at the Venture Capital firm Dragonfly, which is a backer of Polymarket. “It used to be, say, if I think Trump’s going to win, short the dollar. Or go long gold. Or short some U.S. industry. Now, you can just trade it directly.”

While these markets’ long-term prediction capabilities can often equal or beat the predictions of most conventional polls, where they really have an edge is in rapidly responding to events.

On election nights themselves, they can be invaluable tools. Prediction markets can provide a real-time newsfeed of a candidate’s chances based on a remarkably small amount of information — kind of like an expanded version of The New York Times’ needle.

According to data provided by Kalshi, after sitting at around 59 percent all Election Day in 2024, President Donald Trump’s chances spiked to 70 percent by 8 p.m. ET — before most polls in the country had closed. Bettors saw the little information available from certain counties and started flocking to Trump. By 10 p.m., he was at 86 percent. A similar dynamic played out even more rapidly in this year’s New York City Democratic mayoral primary. At 9:01 p.m., Mamdani was sitting at a 42 percent chance of victory. By 9:03, just as the first results began to roll in, his odds had leapt to 68 percent. By 9:30, he was at 95 percent in the market on Kalshi.

Jaron Zhou, the political director at Kalshi, pointed to two big jumps in Trump’s chances on the platform very early on election night 2024. One was when Miami-Dade County’s results came in and showed Trump ahead, and another was when Loudoun County, Virginia’s results came in and showed that Harris was underperforming Joe Biden’s 2020 numbers there. Loudoun County was of particular interest to bettors because it is a very suburban, college-educated county where Harris needed to do well. “Those are the kinds of things where no network will project based off of that, but the markets will react — they will say, ‘Hey, this is a bad sign’ for one candidate or another,” Zhou said.

The markets reacting in one direction or another are far from a sure sign of an outcome. In 2020, for example, Trump was outperforming his 2016 numbers in early-reporting Florida counties, which led to a spike in his overall odds early in the evening. But it turned out Florida had moved right while much of the rest of the country went on to move left — the early numbers were something of a mirage, and the odds had moved far back to Biden’s favor later that night.

And while the oddsmakers like to brag about their real-time accuracy, there’s a reason that mainstream journalistic outlets wait to make a call. An outcome with a 95 percent chance of occurring means that 1 in 20 times something else happens. That’s not a standard that organizations making race calls can live with.

Markets can also much more quickly respond to inputs than tools like polling models. Within the first 10 minutes of the debate between Biden and Trump, for example, Biden’s chances of winning the election according to prediction markets began to plummet.

“No statistical model can do that until the debate performance starts to show up in polls,” said Rajiv Sethi, an economist at Barnard College. “That’s a great example of rapid response.”

Political betting professionals see a whole world that can be built around their simple markets. Chougule is not as sure as the company men at PredictIt, Polymarket and Kalshi that prediction markets will only continue to blow up from here. But when he thinks about what the future could look like, he thinks big.

“Can we create our own media ecosystems?” he asked. “Can there be an ESPN for prediction markets?”

Over at Kalshi, they are direct that this is their goal.

“The novelty and potential here is a unified election experience,” says Zhou. “In the lead-up to the election, people might look at the 538 forecast, when it existed. On election night, people might go to CNN or The New York Times and look at their live votes. That could all be Kalshi [instead].”

When I asked Zhou whether they’re building something that he felt could supplant something like watching CNN on election nights, his answer was simple: yes.

Zhou’s prediction of world domination relies on the idea that prediction markets are better predictors of outcomes than polls or traditional journalism. But that itself remains in dispute. A paper from scholars at Vanderbilt University tested Polymarket against traditional presidential polling and decided that yes, this prediction market was a better predictor in 2024.

But 2024 is just a single data point. In 2016, for example, prediction markets underrated Trump’s chances compared to the 538 model. With few major U.S. elections that have a lot of betting volume to study, the truth is that it’s still not possible to know for certain whether prediction markets can consistently outperform polling averages.

If betting platforms were to become more influential and mainstream than they already are, as their supporters hope, there are other, larger fears about the potential societal impact of these markets that could become more likely.

“The real dark scenario that gets mentioned sometimes is this assassination market idea,” said Schmidt. “[You have a market that asks], ‘Will Trump be alive by the end of the year?’ I could go with a bunch of millionaires and pay to assassinate a political figure.” As Schmidt went on to note, the platforms themselves have stringent regulations around this sort of behavior — and most experts in the field believe this scenario to be very unlikely.

Still, there are other, non-assassination-related fears. “There is the outright interference problem where someone drops false info/deepfakes in the days before an election that go viral on social media and are accepted as fact before it can be countered. As AI becomes more available and useable, this is going to become a very serious problem,” wrote Dennis Kelleher, the president and CEO of the think tank Better Markets, after the 2024 election.

Then, there’s the potential for manipulation by politicians themselves. Recently, for example, the investor Bill Ackman publicly suggested to New York City Mayor Eric Adams that he place a large bet on Polymarket on Andrew Cuomo, drop out of the race for mayor, endorse Cuomo and profit. A former SEC official argues that this would in fact have been illegal. (Ironically, Adams wouldn’t have made much cash from the transaction; after a small, short-lived bump in Cuomo’s odds after Adams dropped out, Cuomo is back down to the low teens, around where he was for most of the summer. On Thursday, Adams endorsed Cuomo.)

And even without any direct manipulation, the very existence and growing popularity of these markets can affect election outcomes.

“Beliefs about what’s going to happen in an election can affect what actually happens,” said Sethi. “If the forecast according to a market for a candidate suggests that they have a very limited chance of winning, that’s going to do things like suppress morale and turnout. It can lead to certain kinds of momentum effects that cause that prediction to come true.”

Concerns about the accuracy and potential downstream effects of the growth of prediction markets haven’t stopped investment from pouring in, though. In large part, that’s because government regulation of these markets has lessened as a concern.

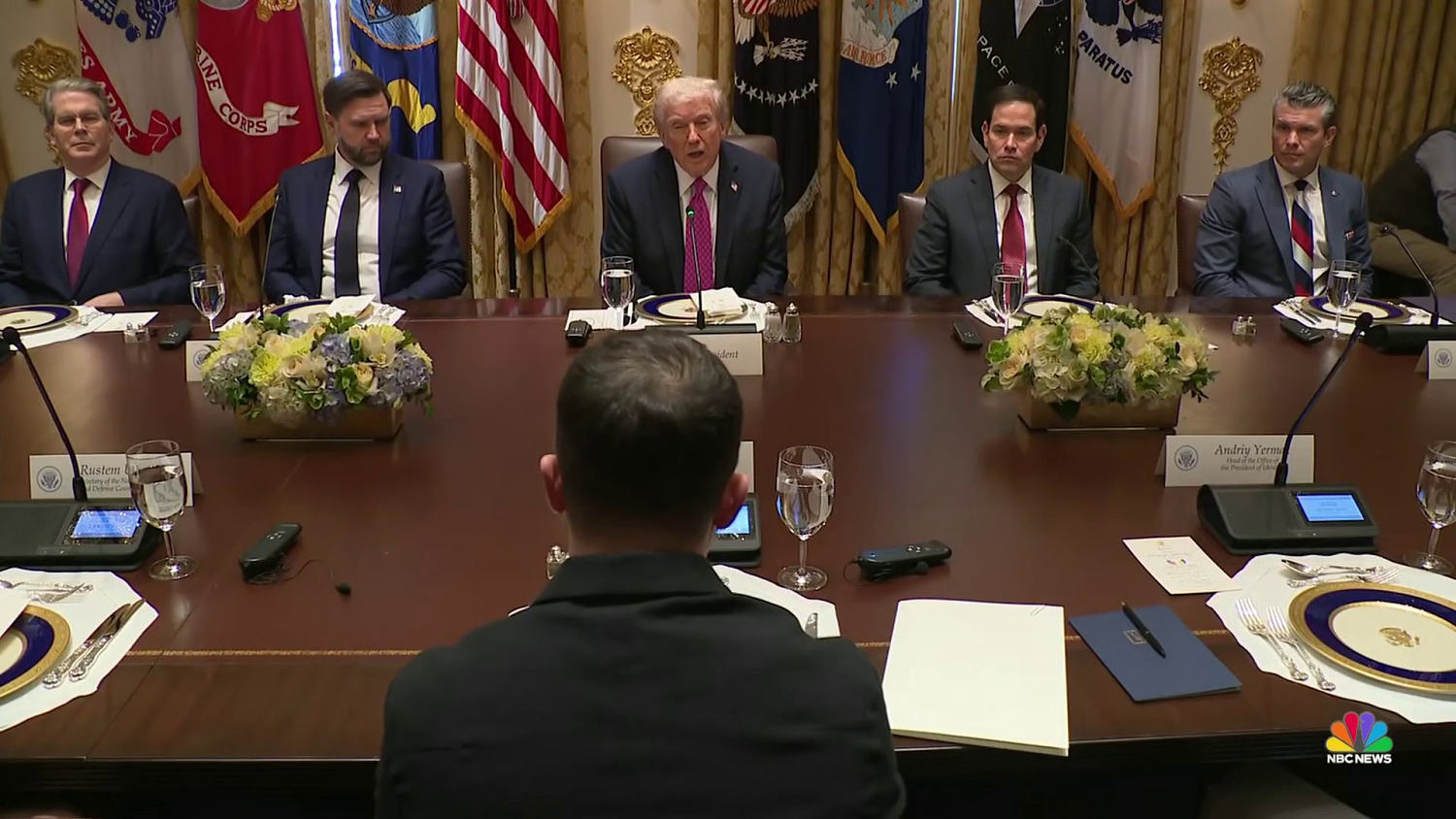

While the Biden era saw a number of attempts to shut political platforms down or disallow most betting on politics, since Trump has come into office, the political situation has flipped. In mid-2025, Polymarket announced that U.S. investigations into the app were closed and began to move toward an on-ramp into U.S. markets, working with the Commodity Futures Trading Commission. Also this year, the CFTC and PredictIt reached an agreement which allowed PredictIt to open new markets, without many of the regulations that it operated under previously. And after winning its suit, Kalshi has been able to proceed without interference from the government. It likely helps to have friends in high places; Donald Trump Jr. is a member of the board of both Polymarket and Kalshi, despite the fact that the two platforms have a long-held rivalry with one another.

To actually live up to their sky-high valuations, Kalshi and Polymarket have to continue to onboard new, regular users and get more money flowing through the platform. One of the best ways to do that is to increase brand awareness — to become a one-stop shop for entertainment and news, filtered through betting. That also happens to align with the future Zhou envisioned, where news consumers would flood betting market websites instead of CNN on election nights.

But there are some potential roadblocks to that future.

“Customer acquisition is hard in this space. … How big [these markets] get, I don’t know,” Chougule said. “To make [prediction markets] the way that normal people consume the news, I don't know, there are probably limits.”

Whether prediction markets will be a hotly debated sideshow in American politics or change the way that most voters look at elections remains to be seen.

“[The market] is not just for Wall Street traders. It is for people who are deciding how they're going to cast their vote, or even if they're going to go out and vote,” said Phillips.

Depending on your perspective, that sounds either like a dream or a nightmare.

.png)

English (US)

English (US)